Are You An Employee Searching for Information About Payslips?

If you are employed and wondering “what is a payslip,” then this information guide is the place for you! Understanding your payslip can be the gateway to financial security and prosperity.

The issue of a payslip can be more complex than simply listing basic salary and deductions, to meet company and labor standards accurately and legally. Employers need the correct payslip created as accurately as possible in order to maintain transparency while preventing potential payroll errors from occurring.

Read this blog to gain more knowledge of what a payslip means, its format and benefits, as well as other related topics.

What Is A Payslip?

A payslip or salary slip issued by an employer to an employee containing details of his/her earnings during any particular pay period is known as a payslip or salary slip.

Payslips provide an overview of wages, deductions and other factors of salary structure. A payslip serves to show employees exactly how much money they’ve earned during a certain timeframe and how it came about.

Payslips are typically distributed either electronically or physically on a weekly, bi-weekly, or monthly basis, depending on the payroll frequency of their firm.

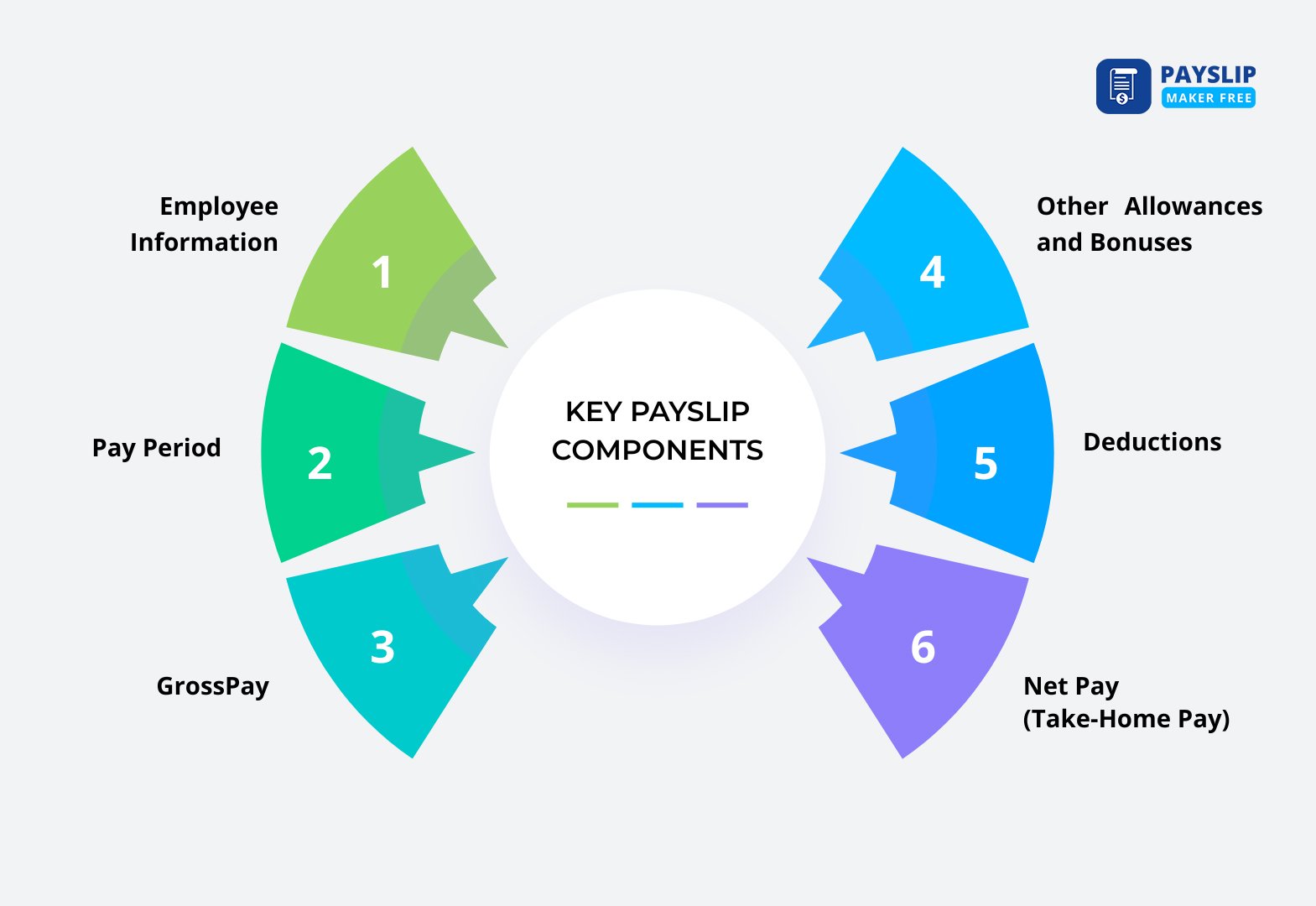

Key Payslip Components

Payslips provide vital information that enables employees to better comprehend how their salary is determined. Each section offers information regarding earnings, deductions, and the total pay structure.

The following are among the common elements often included in a salary slip:

- Employee Information: Employee name, position or title, employee ID, tax number, and sometimes department.

- Pay Period: The dates the payslip is covering, that is, the date range for each pay cycle.

- Gross Pay: The total amount an employee receives prior to deduction, and includes the base salary, bonuses, commissions, and overtime.

- Other Allowances and Bonuses: Other payments such as travel allowance, meal allowance, etc., or performance bonus.

- Deductions: What is subtracted from gross pay, usually income tax, social security, health insurance, and pension funds, is considered as payslip deductions.

- Net Pay (Take-Home Pay): An employee’s take-home pay after all deductions have been taken out and is typically directly deposited.

All of these areas in a payslip format are important to provide transparency in salaries and to assist employees in confirming their salary payments.

Wondering how to create an accurate payslip for yourself?

No more hassles to create an accurate and professional payslip, generate an easy and customized payslip.

Types Of Payslips You Need To Check

Employers may issue payslips in varied forms depending on their payroll system and organizational preference. Employees may get a payslip in a different format, and here the types of payslip are mentioned.

The following are the most prevalent types of payslips that are given to employees:

-

Digital Payslips

After the correct payslip calculation, the payslips are created and delivered electronically via email or accessed through a web-based employee portal. Digital payslips are convenient to access, more secure, and environmentally friendly than paper-based ones. They also simplify record-keeping for both employees and employers. You can generate an accurate payslip by using the Payslip Maker Free tool.

-

Paper Payslips

Conventional printed payslips are distributed to employees in paper form. Though organizations continue to implement this practice, it is slowly becoming obsolete with the increased trend towards electronic systems.

-

Automated Payslips

Automated payslips are produced with payroll software to eliminate the potential for human error and to remain tax and labor law compliant. The system enables companies to conduct payroll efficiently, store data securely, and access previous payslips at any time with ease.

Importance Of Payslip Format

Payslips are more than simply records of earnings; they play an indispensable role in financial management, compliance, and proof of employment.

The following are some of the most important reasons why payslips are necessary:

-

Employment Information

Payslips provide official documentation of salary payments and employment histories, providing essential evidence when seeking new work, applying for visas/work permits or auditing companies; for employers, they provide key data for audits, financial reporting, or settling payroll disputes.

-

Financial Record Keeping

Financial institutions typically request payslips from applicants when applying for credit cards, loans, or mortgages. Employers also use payslips as proof of salary information when offering benefits such as bonuses, insurance coverage or retirement contributions to employees.

-

Tax Compliance

Payslips provide employees with a way of keeping track of income tax and statutory deductions, making filing their tax returns simpler and confirming they were properly made if necessary; additionally, they allow employees to claim refunds if required.

Payslips may also be requested as proof of income in legal and financial proceedings that require proof.

Payslips serve to promote transparency and compliance and are an essential employment and financial document for both employers and employees alike.

How To Read a Payslip & Prepare It

Both employers and employees need to know payslip meaning. Employees should monitor their earnings and deductions, while employers maintain correct payroll.

Below is a step-by-step guide on reading a payslip and issuing one appropriately:

| Reading a Payslip | Creating a Payslip |

|---|---|

| Payslips provide an accurate view of an employee’s salary. Key areas to note include: | Preparing payslips can be done both manually and with payroll software, each process involving similar steps. Here is what happens during each one: |

| Basic Salary: Regular pay depends upon an employee’s position and duties. | Collect Information: Collect data regarding an employee’s base salary, allowances, bonuses, and deductions. |

| Allowances: Supplemental payments such as transport, housing, or performance bonuses may be awarded as supplements. | Calculating Gross Salary: When calculating gross salary, add basic salary with allowances, bonuses, and any other remuneration to determine total earnings before any deductions. |

| Deductions: Subtractions made to a gross salary for taxes, insurance premiums, or loan repayments. | Apply Deductions: Take into account any deductions available, such as taxes, insurance premiums, retirement fund contributions or any other that might apply when making deductions. |

| Net Salary (Take-Home Pay): Employee payment or paycheck is calculated after deductions. | Determine Net Salary: After deductions have been taken out, an employee’s take-home pay will be determined. |

| Additional Incentives: Supplementary income sources such as overtime payment, bonus, or commission may help supplement existing sources. | Produce the Payslip: Utilize either a template or payroll software to quickly create a comprehensive payslip outlining all earnings and deductions. |

| Pay Period: It is counted as the start and end dates of the salary cycle. | Disburse the Payslip: Distribute payslips among employees in either written form or digitally via email or employee portals. |

By performing these steps, employers can maintain precise payroll management, and employees can learn about their payslip format, deductions, and net earnings easily.

Payslip Examples

When creating a payslip for official or employee records, you can use dedicated payroll software or a free payslip maker, but make sure it covers the essential elements discussed earlier – basic salary, allowances, deductions, net pay, pay period, etc.

You can check the payslip example if you want to make your own payslip. Or you can generate the payslip by using our tool.

FAQs:

1) What is payslip used for?

A payslip gives employees a detailed record of their pay, deductions, and net pay. It gives employees the ability to accurately keep track of their pay, while also giving them confidence that all payments are correct. And then of course, payslips are also valuable to document employment and income when applying for loans or tax filings, along with accurately tracking pay and verifying correct payments.

2) What is the purpose of a payment slip?

Payslips give workers a detailed account of the calculation of their pay, including all allowances, bonuses, and deductions. They provide transparency between employers and workers regarding payments while reconciling whether taxes and other deductions have been accurately deducted from employees’ salary.

3) Is a salary slip given every month?

Yes, employees receive salary slips every month to provide them with an accurate picture of their finances and ensure compliance with labor law regarding timely salary documentation.

4) What is the full meaning of a payslip?

Payslips, more commonly referred to as salary statements or “Pay Slips”, are documents issued by employers which detail an employee’s pay and salary information, including basic pay, allowances, deductions, net salary and any applicable bonuses or tax withheld from earnings. Payslips serve as official evidence of earnings in various situations.

5) How do I get a payslip?

Payslips can be obtained either in printed form, digitally via email, or an employee portal from your employer – they’re typically generated by payroll departments and software – making them accessible and allowing you to verify both salary and deductions more accurately. Having access to this document is essential so you can remain accurate.