A payslip is a document provided to an employee at the end of the month, along with their salary, which includes the salary records and the tax deducted.

With a huge number of calculations and compliance regulations involved, it is always a critical task to create the right data. A need for a system that not only generates the right data but also calculates the numbers correctly.

An online payslip generator manages and controls the whole payroll process on one user-friendly interface. The system is not effective in terms of data management, but it also reduces risk and cost to improve efficiency and data protection.

This guide compares the top 10 free payslip generators in 2025 for your business. Let us take a look at them.

Top 10 Free Payslip Generators

The following are the top 10 free payslip generator for your business:

1) Payslip maker free

With the payslip maker free, you can create your own salary slip without any hassle. No matter if you’re a self-employed individual or an employee in need of immediate proof of earnings, this free salary slip generator will help you create one.

Pros:

- Easy-to-use interface.

- Free salary slip generator.

- Employers, HR departments, and small businesses can easily create a salary slip.

- You can generate editable salary slips without any hassle.

Cons:

- Currently there are limited payslip templates.

2) Zoho

Zoho brings a diverse salary structure that suits each employee and your firm’s hierarchical structure with custom earnings and deductions. With a modern UI at your fingertips, you will get to know Zoho Payroll faster and complete payroll instantly.

Pros:

- You can generate payslips for free.

- Designed for Indian audiences, which supports indian statutory components.

- You can upload your company’s logo and customize your pay period.

Cons:

- It is limited in functionality.

- Once salary is added to the field, you cannot hide it.

- This requires manual data entry for each employee and each pay period:

3) Paysliper

With paysliper, you can create an easy slip by using the employee payslip generator. Check that the final payslip meets Indian statutory payroll requirements. The tool may allow you to add custom fields, but accuracy is a must.

Pros:

- You can claim support for different pay period frequencies.

- You can download your paystub in PDF format.

- This platform is web-based and can be accessed through phone and desktop easily.

Cons:

- It lacks advanced features such as automatic calculations and bulk slip generation.

- For huge organizations that need a complex payslip, which might not scale with per per-pay tool.

4) Hmware

Hmware is a free payslip generator in India tool which can be used to design salaryslip and can download it in PDF format. While the targeted audience in India might be small business owners, it eases the use of speed by avoiding heavy payroll software.

Pros:

- It is free to use, and it’s a web-based interface means there is no need to install specific software.

- It is flexible for small team members because there is no heavy setup required for it.

Cons:

- For firms with many employees, frequent pay cycles might use a tool that can become cumbersome because each payslip needs manual input, and there is no mention of advanced automation.

5) Asanify

Asanify Payslip Software provides an easy-to-use cloud-based solution for companies to generate professional, branded salary slips in minutes. It allows employers to customize formats and gives employees immediate access to payslips via web or mobile, supporting urgent needs such as loan applications or insurance claims.

Pros:

- The user can choose to show bank details and daily status per employee.

- Quick generation of a salary slip using the easy payslip generator is a hassle-free process to use.

- Suitable for the indian audience who need an instant salary slip.

Cons:

- It is suitable for small business owners and freelancers who need a customized payslip for their clients, but with its basic level powers, it does not support full functionality.

- Third-party integration is not as mature as compared to some other payroll tools.

6) PHP Payroll

PHP Payroll is a free payslip tool that lets businesses create quick and professional slips instantly in PDF format.

Pros:

- Easy-to-use interface.

- Good for small business owners and freelancers to instantly create pay stubs.

Cons:

- It is a basic tool that lacks advanced features like automated statutory calculations.

- There is no mention of data security features, which is a concerning thing while handling sensitive data.

7) Salarybox

Salarybox is a mobile all-in-one application for Indian business owners that streamlines compliance as well as HR management.

Pros:

- Salarybox supports automated salary calculations and digital payslips, which reduces manual effort and ensures error-free calculations.

- With this tool, you can integrate tracking attendance and payroll, which also offers a real workforce solution for management.

Cons:

- Salarybox does not have an intergenerational facility available with other HR software.

- The starter pack is affordable, but to get all modules, you will need to pay a fixed amount, which might not be suitable for freelancers to pay.

8) Keka

The Keka Payslip Generator is a free payslip generator tool provided by Keka HR & Payroll that allows employers to quickly create professional salary slips by entering company details, employee information, earnings, deductions, and pay period.

Pros:

- Its interface is clean and easy to use, and is created for accuracy.

- Employees can download their slips from the portal, which is helpful in bulk slip generation.

Cons:

- Large organizations with highly customized salary structures or international payroll requirements may find the tool less flexible than bespoke enterprise payroll solutions.

- This tool requires manual entry of data and is designed in a very generic way

9) HR Stop

HRStop is a cloud-based, all-in-one HRMS and payroll platform designed to manage the entire employee lifecycle, from hiring to retirement.

Pros:

- HR Stop has strong automation, and it helps in reducing the need for multiple free payslip tools.

- The platform supports customization and API integration, which is helpful if your business is growing.

Cons:

- This tool has a slower response time and has an unclear pricing structure for its specific needs

10) Conta

Conta Invoice Generator is a free, browser-based billing tool designed for freelancers, small businesses, and contractors– especially in India – allowing you to generate professional invoices in minutes by entering client and service details.

Pros:

- This tool allows you to create slips in under 1 minute by using the employee payslip generator.

Cons:

- The generator has a basic feature and lacks advanced features like recurring invoices and customer databases.

FAQs

1) Is a payslip generator free to use?

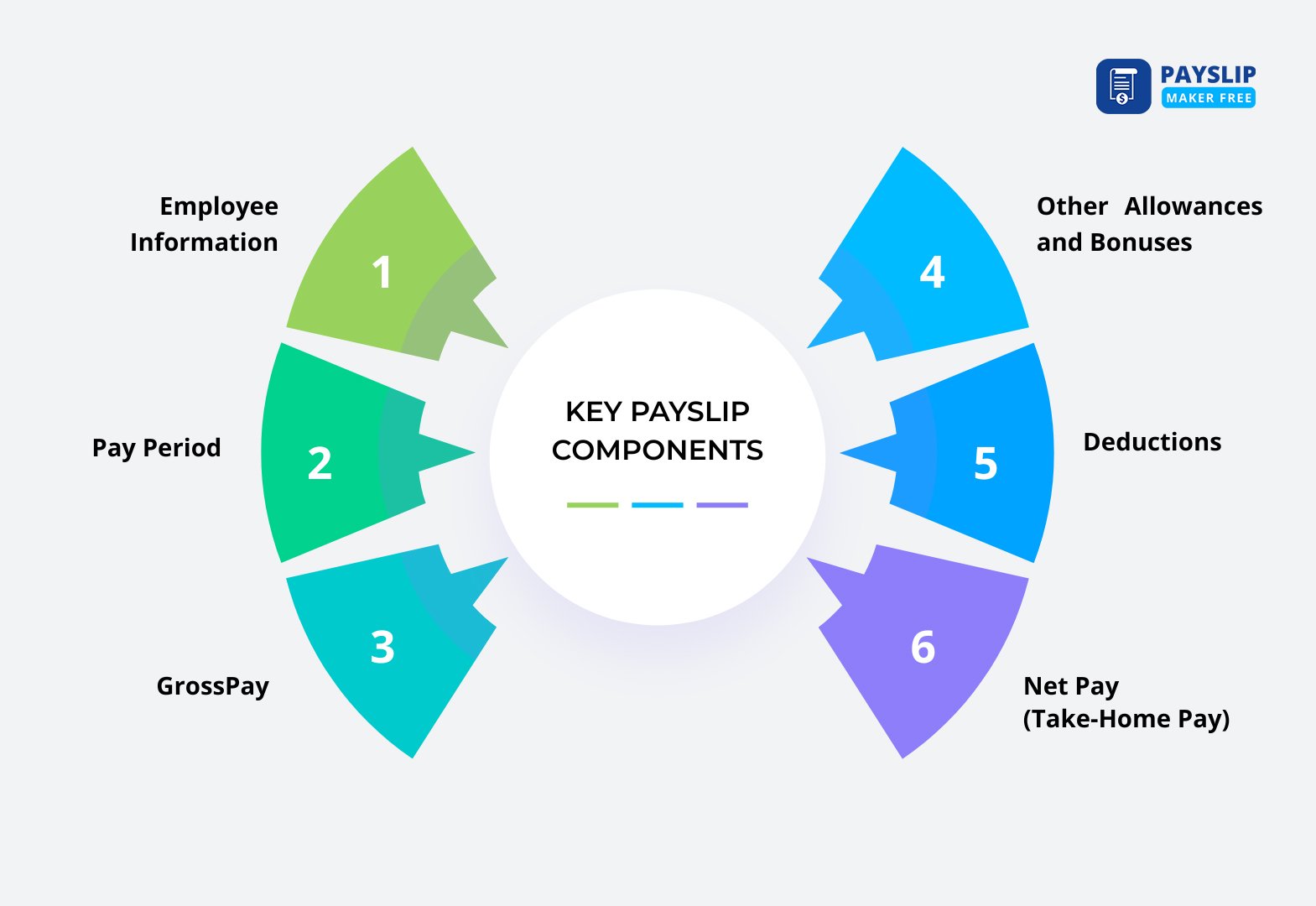

Free payslip generator is a tool that helps users create free slips for their business. Employers can add the relevant components of an employee’s salary to an existing template to create a payslip.

2) How accurate is the digital payslip generator?

Paystub generators usually include built-in calculations for taxes, deductions, and other payroll components. This reduces the risk of errors compared to manual calculations, ensuring your pay stubs are accurate and comply with relevant regulations.

3) How is a payslip verified?

Banks and lenders check salary slips against bank statements and tax records. They may also contact employers to confirm the details.

Key Takeaways

Choosing the right free payslip generator in 2025 depends on your business needs, whether you are a freelancer, small business owner, or HR professional. Each tool offers distinct benefits, including automation, accuracy, easy customization, and record-keeping.

While free versions are suitable for basic payroll management, exploring paid plans can provide advanced features such as tax compliance and integrations.