Managing payroll effectively in today’s era is vital for businesses of all sizes. Whether you’re a small business owner or an HR professional, creating paystubs manually is a time-consuming process and is prone to error.

A Free Payslip Generator provides an intuitive solution for those who need to create professional pay slips without investing in expensive software. In this guide, we’ll take a look at creating a pay slip using a free pay slip generator.

What is a Payslip?

A Payslip is a document that employers provide to their employees to show their total wages for a certain period. This includes the total amount earned, which also reflects the deductions for tax payments.

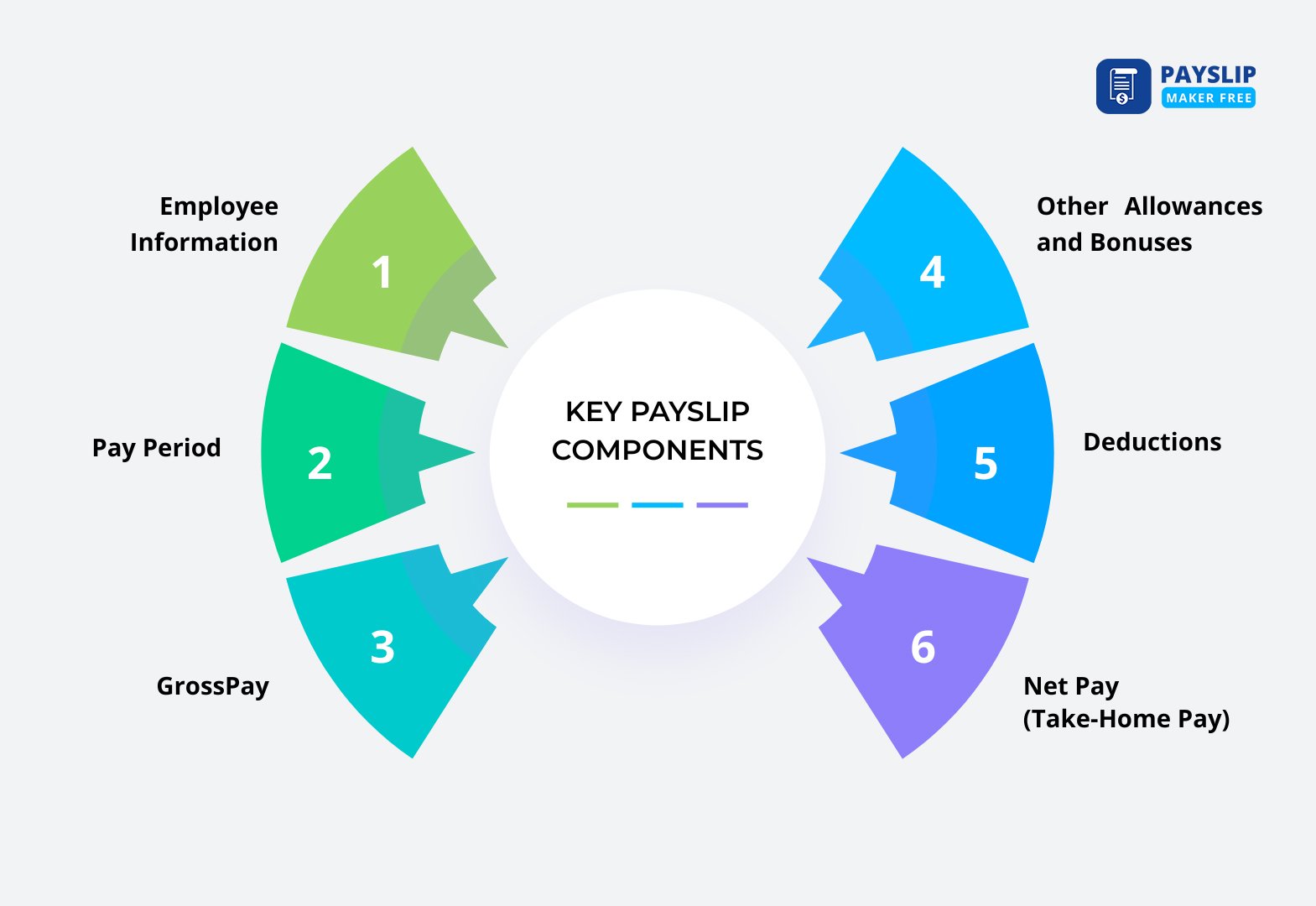

With the help of a payslip generator, not only used for salary payments, it should have the following:

- Wages

- Income tax

- Employer contributions for retirement benefit funds

- Reimbursement

- Deductions for other contributions

- Amount of time/leave owed

Earlier payslips were hard copies, which were given to employees with a cheque. Nowadays, employers prefer to give out digital payslips, which are available for employees online.

What is a Free Payslip Generator?

A Free Payslip Generator is an online tool that can be used to create accurate salary slips easily without paying anything. It helps employers or individuals create professional pay stubs by inserting basic details such as:

- Employee name and ID

- Salary details

- Deductions

- Payment date

Once you fill in these details, the salary slip generator free will calculate the net salary automatically and produce a downloadable payslip within minutes.

Why use a Free Payslip Generator?

Payslips are not just any documents. They are essential documents of an employee’s earnings, deductions, and net pay. Regardless of the size of the company, it is required to provide employees with accurate payslips.

Creating payslips manually causes errors on your slips, especially when dealing with multiple employees. A free salary slip generator allows you to automate this process. Below are some benefits:

- Accuracy: Automatic calculations minimize the risk of errors in tax, deductions, and net payout, which is ideal for small businesses.

- Time-saving: You can instantly produce multiple payslips in just minutes instead of taking hours to input them by hand.

- Professional appearance: Payslips produced are professional in appearance and can enable you to maintain a stature among your employees.

- Cost-effective: These tools are cost-effective and free; freelancers can save money on expensive software.

- Easy to use: Most free payslip generator online tools are user-friendly and require no technical knowledge.

Features of the Online Payslip Generator Free

An online payslip generator free tool, comes with various features that make payroll management easier. Common features include:

- Employee Information: Insert basic details like employee name, position, employee ID, and contact details.

- Salary Breakdown: Insert elements like basic salary, allowances, bonus, and deductions such as provident fund.

- Automatic Calculation: The Free Payslip Generator automatically calculates gross salary, deductions, and net pay.

- Download: Once the payslip is generated, you can download it in PDF format.

How to use a Free Payslip Generator Online?

To generate payslip using the salary slip generator free:

Visit the Payslip Generator Website:

First, open your browser and go to Payslip Maker Free. The interface is simple and user-friendly, making it easy for anyone to use, whether you are a small business owner, HR professional, or freelancer.

Insert Employee Details

Once you’re on the generator page, begin by filling in the employee information. This includes:

- Employee name

- Employee ID

- Designation

- Department

- Contact Information

An accurate employee detail will make sure that the payslip is professional-looking.

Fill in Earnings Components

Most of the Payslip Maker Free allow you to enter:

- Basic Salary: This is the fixed component of the employee’s salary.

- Allowances: Any additional earnings, such as transportation.

- Bonus: Annual bonus

Deductions

Insert earnings and add any deductions. Common deductions include:

- Tax deductions

- Provident fund contributions

- Loan deductions

Preview Paystub

Before you can finalize your paystub, you can preview the payslip to check that all the records are correct. Ensure that the employee’s name, earnings components, deductions, and net pay are correct.

Create and Download

Once everything is in place, preview the slip and hit the create button, and download them in PDF format.

When to use a Free Payslip Generator Online?

To generate payslip online free under various circumstances, you should do the following:

- Monthly Payroll: Create a monthly salary slip quickly for all employees.

- Freelancers: You should provide a legal payment record to clients.

- Startups: Avoid manual errors and save on payroll costs.

- Audit & Tax Filing: Maintain organized records for tax reporting purposes.

Choosing the Right Payslip Maker Free

With so many free payslip generator online in the market, below are the main features to consider:

- Ease of use: Easy-to-use interface.

- Customizable templates: It has the power to adjust the design and layout of the slip.

- Multiple formats: There will be an option to download the slip in various formats.

- Security: Encryption features for sensitive data handling.

Key Takeaways

Any business or even a one-person operation, for that matter, needs to find a way to do payroll efficiently.

The free pay slip generator provides a straightforward, low-cost, and reliable means of producing accurate pay slips. This kind of solution not only saves a lot of time but also minimizes mistakes and helps ensure a transparent worker’s payment system because of features like automatic calculations, nice templates, and safe storage.

Whether you are a small business owner, a self-employed worker, or an HR department member, with the help of a free online pay slip generator, you are paving the way for a smooth and professional payroll process.

FAQs

1- How can I create my own payslips?

Pay Slip Maker Free allows you to create a free online pay slip, which is completely customizable to include company information and individual employee details. The fields in our payslip generator are completely flexible and can include any custom field titles you require.

2- How does HR verify the salary slip?

Intensive verification of documents helps in identifying discrepancies. Employers check offer letters, bank statements, and salary increment letters for mismatched details. They also verify TDS deduction on Form 16 and salary credit in the bank statement. Any discrepancies raise red flags.

3- Can payslips be faked?

Yes, it can be faked. Creating fake payment slips to rent a property, apply for a loan, request installments, or fulfill the requirements of other financial applications. Such fraudulent actions are extremely risky, and false claims about true financial capability can lead to serious problems.

4- Do banks verify salary slips?

Salaried borrowers will have to provide income proof documents for the personal loan assessment. Lenders usually verify salary credits, employer details, and monthly income stability. This review is part of the comprehensive loan documentation process.